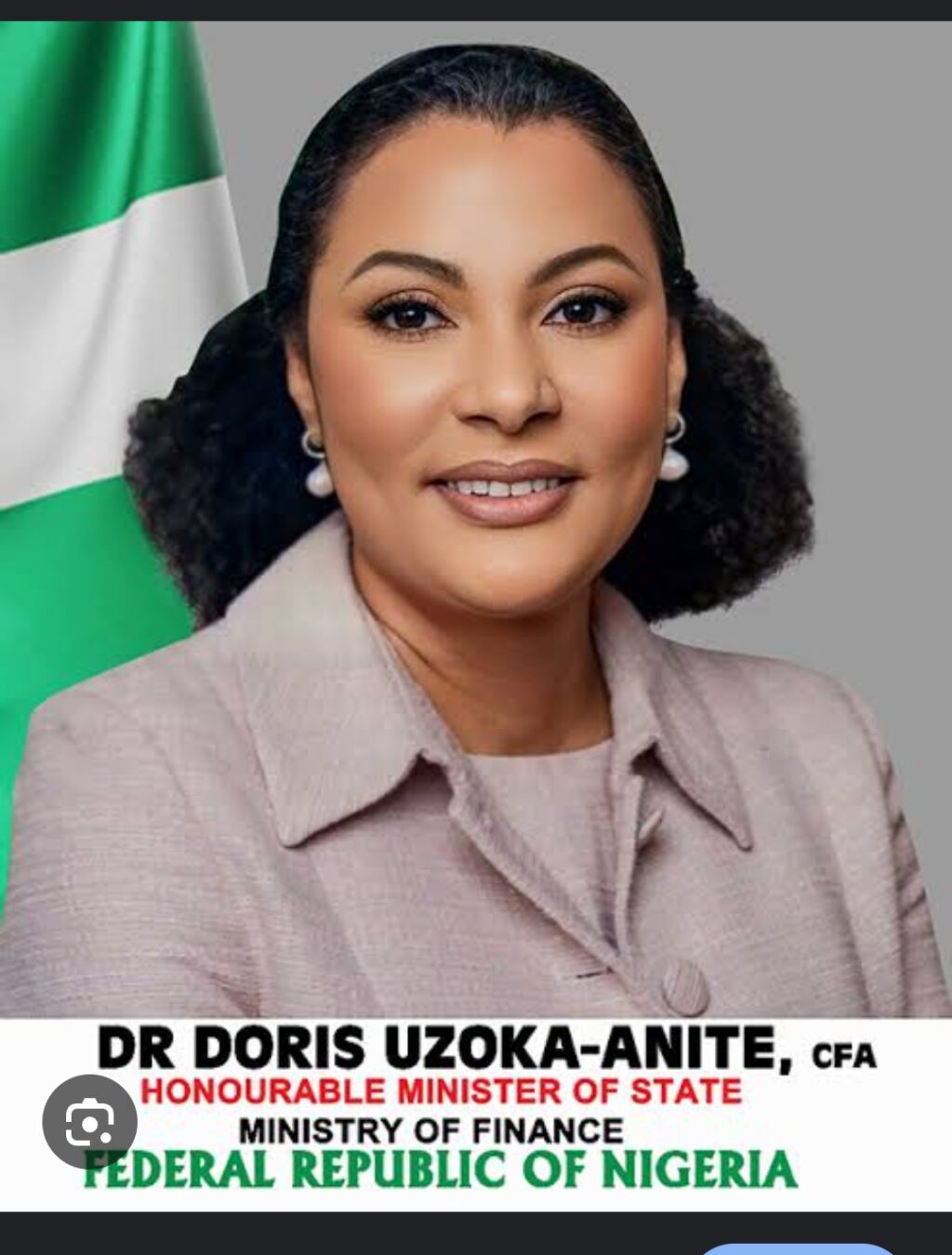

The Minister of state for finance Dr Doris Uzoka-Anite and the Chairman of the Federation Account Allocation Committee (FAAC) has commended President Bola Tinubu on the recent executive order.

The executive order mandates the direct remittance of certain oil sector revenues to the federation account.

While addressing members of FAAC in Abuja on Friday, Uzoka-Anite said that the presidential executive order would safeguard oil and gas revenues.

She said that the order would provide regulatory clarity and significantly strengthen revenues accruing to the federation account.

The minister described the development as a structural fiscal correction aimed at restoring constitutional discipline to petroleum revenue management and enhancing distributable income across the three tiers of government.

She said that the revenue outlook was improving due to ongoing structural reforms introduced by the Federal Government.

According to her, the newly implemented tax reform measures are broadening the tax base, improving compliance and enhancing administrative efficiency.

“Also, the executive order signed by Mr president on Feb. 13 is reinforcing revenue discipline in the oil and gas sector and reducing leakages,” she said.

The minister said that the order suspends the 30 per cent allocation to the Frontier Exploration Fund (FEF), suspends the 30 per cent management fee on oil and gas profit payable to NNPC Limited.

She saiid that the order also directed that gas flare penalties be paid into the federation account, and mandated full remittance of petroleum revenues without unconstitutional deductions.

Uzoka-Anite said that the reform marks a shift from a retention-based oil revenue model to a gross remittance, federation-first model.

“The implications for FAAC are very significant, more oil and gas profit will now flow directly into the federation account.

“Gas flare penalties will become distributable revenue, and previously retained management fees will no longer reduce remittable inflows,” she said.

She said that the reforms were expected to result in higher monthly gross inflows into the federation account, and increased allocations to federal, state and local governments.

Uzoka-Anite said that a retrospective audit of the FFF, the Midstream and Downstream Gas Infrastructure was due, and NNPC management fee deductions could lead to recoveries that may provide a one-off fiscal boost.

She welcomed the improved revenue outlook and cautioned against the risks associated with sudden liquidity injections.

“Experience shows that when revenues rise sharply and are distributed fully and immediately, large liquidity injections can increase inflationary pressures, complicate monetary management and reduce the real purchasing power of allocations,” she said.

She said that excess aggregate demand, exchange rate pressure, asset price distortions and inflationary risks could arise if increased inflows were not carefully managed.

Uzoka-Anite said that to mitigate such risks, she proposed phased disbursement of one-off recoveries.

She suggested that retrospective recoveries be staggered rather than injected into the economy in bulk, with a portion temporarily warehoused in a stabilisation buffer.

She also recommended strengthening the excess crude and stabilisation buffer mechanism to channel part of incremental inflows into a fiscal stabilisation window.

“This could offset revenue shortfalls in weaker months and reduce procyclicality in spending.

According to her, enhanced coordination with the CBN would be pursued to align fiscal injections with liquidity management tools and support open market operations where necessary.

Uzoka-Anite urged states and federal Ministries, Departments and Agencies (MDAs) to prioritise capital expenditure over recurrent expansion.

He called for investment in infrastructure, agriculture, energy and other productive sectors, and avoid unsustainable wage or consumption spikes.

“Productive spending expands supply capacity and mitigates inflation,” she said.

She also announced plans to introduce monthly revenue transparency dashboards, production-to-remittance reconciliation reporting, and clear reporting of incremental inflows arising from tax reforms and the executive order.

Uzoka-Anite said that the reforms presented an opportunity to deepen fiscal federalism, enhance distributable revenue, restore constitutional clarity and strengthen trust among tiers of government.

She said that increased revenue must not translate into fiscal complacency.

“We must resist the temptation to treat incremental inflows as permanent windfalls.

“We should reduce debt burdens, clear arrears responsibly, build buffers and invest in growth-enhancing sectors,” she said.